Tokyo Electric Power Company (TEPCO) announced the establishment of

its fiscal 2006 Business Management Plan, setting out the issues and

main management targets that the TEPCO Group will address on a priority

basis over the next three years, with the aim of achieving further growth

and development and continuous improvement in corporate value.

In October 2004, TEPCO announced Management Vision 2010, the medium-term

management policy of the TEPCO Group for the period up to fiscal 2010.

The fiscal 2006 Business Management Plan serves as an action plan for working

toward the objectives of Management Vision 2010 over the coming three years

in line with the three Group Management Guidelines, "Win the Trust of

Society," "Compete and succeed," and "Foster People and Technologies," and

presents the targets to be achieved in the three-year period from fiscal 2006

through fiscal 2008.

The main points of the Fiscal 2006 Business Management Plan are as follows:

I. Win the Trust of Society

The entire TEPCO Group works together to provide a stable and secure supply

of energy, ensure safety and control quality, and strictly observe

corporate ethics, laws and regulations.

In response to the global warming, TEPCO also promotes safe, stable

operation of its nuclear power stations, improvement of thermal power

efficiency, increased use of renewable energy sources and utilizing the

Kyoto Mechanism in order to achieve the environmental contribution goals

set forth in Management Vision 2010 (reduce CO2 emission intensity to 20

percent below 1990 levels by fiscal 2010).

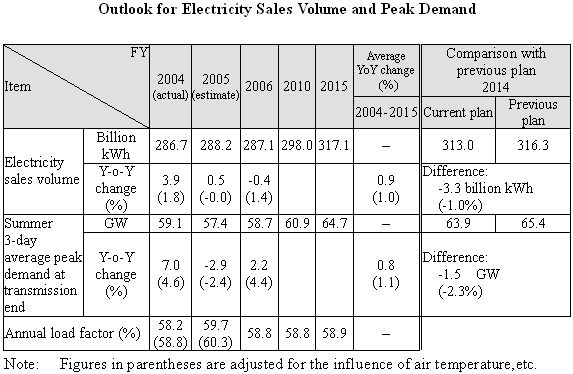

Outlook for Electric Power Demand

While the Japan's economy is expected to grow at a rate of around 1.5

percent per year for the medium to long term, the annual growth rate of

electric power demand is expected to average 1 percent (after adjustments

for air temperature) from fiscal 2004 to fiscal 2015 due to intensifying

competition from other energy producers and advances in energy conservation.

Although demand for cooling in summer mainly for residential and commercial

use is expected to increase, the average annual growth rate of peak demand

is expected to average 1.1 percent (after adjustments for air temperature)

from fiscal 2004 to fiscal 2015 due to factors such as promotion of thermal

storage air-conditioning units.

Despite an expected increase in industrial demand amid a gradual economic

recovery, electricity sales volume in fiscal 2006 is expected to decrease

0.4 percent year on year to 287.1 billion kWh due to a drop in demand for

cooling and heating following the hot summer and severe winter of fiscal

2005. This will be the first year-on-year decrease in three years.

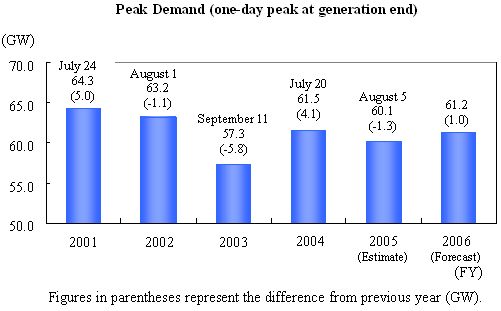

Summer net peak demand (one-day peak at generation end) is expected to be

61.2 million kW, assuming normal summer temperatures.

|

|

|

Power Generation Facility Plan

TEPCO will continue to steadily promote the best mix of power sources

centered on nuclear power based on its fundamental duty to ensure stable

supply and energy security, with overall consideration of factors such as

economics, operability and environmental compatibility.

II. Compete and Succeed

Amid intensifying competition, the entire TEPCO Group will work together to

achieve customer satisfaction by providing total solutions that meet their

increasingly diversified and sophisticated needs quickly and accurately.

The Group will also promote cost reduction in all fields.

Promote Marketing Activities Aimed at Customer Satisfaction

TEPCO aims to expand electricity sales volume by around 5 billion kWh over

the three year-period from fiscal 2006 through fiscal 2008, in line with

the Management Vision 2010 target of expanding cumulative electricity sales

volume by at least 10 billion kWh over the period from fiscal 2004 through

fiscal 2010.

1) Corporate and Large-scale Customers

.TEPCO will offer efficient energy systems that contribute to reducing

costs, energy consumption and CO2 emissions through an optimal combination

of various electricity rate options and electrical equipment and systems

tailored to each customer's current needs and plans.

.To meet diverse and sophisticated customer needs, TEPCO and its Group

companies will work together to become a one-stop source of total solution

services encompassing not only the supply of electricity, gas, steam and

other types of energy, but also planning, construction and maintenance of

facilities including telecommunications; environmental review;

off-balance-sheet transactions; business outsourcing; and other matters.

2) Household Customers

.TEPCO will encourage customers to adopt all-electric housing by promoting

its comfort, energy efficiency, environmental friendliness, dependability,

safety and superior economy through mass media advertising such as

television commercials and the Switch! campaign. In addition, TEPCO will

continue conducting marketing activities that target house planners,

builders and sellers, with the aim of increasing the ratio of all-electric

new housing to 22 percent (roughly equivalent to 95,000 homes) by fiscal

2008.

Promote Cost Reductions

TEPCO's goal under Management Vision 2010 is to improve operating efficiency

in fiscal 2010 by at least 20 percent compared with fiscal 2003. To achieve

this, TEPCO will mobilize the Group's overall strengths to reduce costs in all

fields in ways such as rationalizing facility configuration, operation and

maintenance and reviewing business processes, with facility safety and securing

quality as major premises.

Capital Expenditure Levels

TEPCO will undertake an average of around ¥620 billion in annual capital

expenditures over the three-year period from fiscal 2006 through fiscal 2008,

which is unchanged from levels in the previous plan.

Reduce the Number of Employees

TEPCO will reduce the number of employees to a total of 37,500 by the end of

fiscal 2008 through strict application of ongoing measures to increase

efficiency, including operational and organizational revisions and facility

automation.

Develop Profitable New Businesses to Ensure Growth Potential

Based on thorough selection and concentration, TEPCO will work to achieve

sustainable growth and development for the entire TEPCO Group by promoting

new businesses in the four areas of information and telecommunications,

energy and the environment, living environment and lifestyle-related and

overseas.

Operating Revenues and Operating Income Targets for Businesses Other than

Electric Power

Reflecting the comprehensive alliance with KDDI in the information and

telecommunications business, TEPCO has revised the numerical targets of

Management Vision 2010 (previously, operating revenues of at least ¥600

billion and operating income of at least ¥60 billion in businesses other

than electric power) as shown below. In conjunction with this, TEPCO aims to

achieve the following targets in its fiscal 2006 business management plan.

Specific Targets for Businesses Other than Electric Power

Under Management Vision 2010:

.Operating revenues of at least ¥300 billion

.Operating income of at least ¥50 billion

by fiscal 2010

Under the Fiscal 2006 Business Management Plan:

.Operating revenues of around ¥270 billion

.Operating income of around ¥40 billion

by fiscal 2008

Reference

Information and Telecommunications Business

.TEPCO will commence offering full-scale integrated fiber-to-the-home (FTTH)

services with KDDI.

.TEPCO will offer a variety of services that utilize high-speed PLC* and

other information and telecommunications technologies, including Internet,

energy management, home security and home electronics control services.

*High-speed PLC (Power Line Communication): High-speed telecommunications

using existing electrical distribution lines and household wiring

Gas-related Business

.TEPCO will promote development of LNG upstream divisions, the LNG carrier

business and LNG sales to strengthen its capabilities in supplying

liquefied natural gas (LNG) for thermal power generation and to expand

revenue potential.

.TEPCO will aggressively develop its gas supply business to enable it to

provide total solutions that meet the wide-ranging energy needs of its

customers.

Overseas Business

TEPCO aims to generate new growth and development by seeking new business

opportunities overseas. It will promote power generation projects, diverse

investments and a consulting business that employs TEPCO's technological

capabilities and expertise.

III. Foster People and Technologies

The entire TEPCO Group will work together to create enjoyable and satisfying

workplaces, strengthen and improve technologies and employee skills, and

develop technical strategies that support future growth.

IV. Management Targets

Income and Free Cash Flow

The entire TEPCO Group will work across all businesses to achieve higher

profitability by thoroughly improving efficiency and increasing operating

revenues through aggressive promotion of marketing activities aimed at

customer satisfaction. At the same time, it will work to secure free cash

flow by curbing capital expenditures and other cash outlays, and improve

asset efficiency in ways such as rationalizing facility operations and

reducing assets.

Through such efforts, TEPCO aims to achieve the following targets on a

three-year average basis over the period from fiscal 2006 through fiscal

2008.

Specific Targets

.Ordinary income (Consolidated) At least ¥380 billion

(Non-consolidated) At least ¥350 billion

.Return on assets (ROA) (Consolidated/Non-consolidated) At least 4%

.Free cash flow (Consolidated/Non-consolidated) At least ¥400 billion

Balance Sheet Improvement

Improving the balance sheet is a critical task for TEPCO in an operating

environment characterized by major changes, such as the increase in scope of

liberalization and intensifying competition among types of energy. TEPCO

will take measures to increase the shareholders' equity ratio, such as

selectively allocating free cash flow to reduce interest-bearing debt.

Specifically, TEPCO aims to achieve the following targets by the end of

fiscal 2008 in order to meet the numerical target of Management Vision 2010

of increasing the shareholders' equity ratio to at least 25 percent by

fiscal 2010.

Specific Targets

.Shareholders' equity ratio (Non-consolidated): at least 23% (as of the end

of fiscal 2008)

(Non-consolidated interest-bearing debt to be reduced by at least ¥700

billion over the period from fiscal 2006 through fiscal 2008)

Management Vision 2010 (Medium-Term Management Policy of the TEPCO Group)

Based on the TEPCO Group's management philosophy of contributing to better

lifestyles and environments by providing superior energy services, TEPCO

established three Group Management Guidelines under Management Vision 2010

- to win the trust of society, to compete and succeed, and to foster people

and technologies - and set five numerical targets in line with these

guidelines.