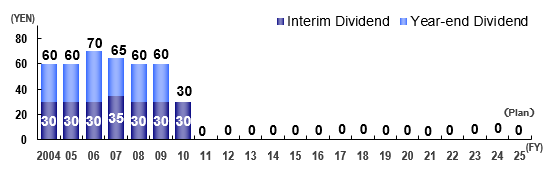

Dividends

(October 30,2025 Update)

Dividend Policy

Considering current severe business environment etc. since the Tohoku-Chihou-Taiheiyou-Oki Earthquake, Tokyo Electric Power Company Holdings has decided to withdraw its existing basic dividend policy. While we strongly recognize sharing corporate profits to our shareholders through its value creating management as one of the primary tasks, our basic dividend policy is to be revised with careful consideration of our business circumstances and performance.

FY2024 Dividend and FY2025 Dividend Outlook

Looking at financial results from the FY ending March 31, 2025, operating revenue decreased mainly due to a decrease in fuel cost adjustments caused by falling fuel prices, etc. Regardless, we secured ordinary income and recorded net income attributable to owners of the parent based on continuous group-wide cost reductions and other efforts.

However, given the severe business environment that we are in, we regret to inform our decision to pay no dividend for the current fiscal year.

We also pay out no interim dividends and plan to pay out no year-end dividends as well for the fiscal year ending March 31, 2026, as the business environment is expected to remain challenging.

Dividend Trends

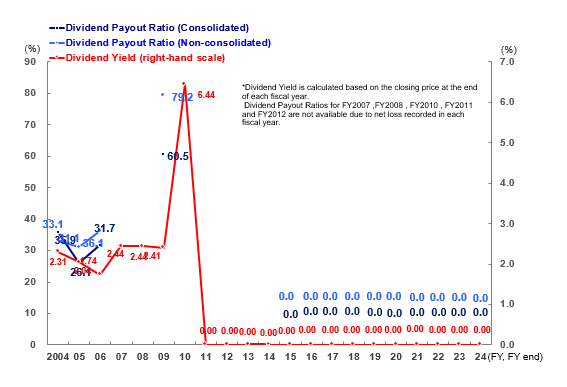

Dividend Payout Ratio, Dividend Yield

Dividend Yield is calculated with the closing price at the end of each fiscal year.

Dividend Payour Ratio cannot be calculated for FY2007,FY2008,FY2010,FY2011 and FY2012 due to net loss.